Determining cost basis for rental property

The total is your true cost basis for the property. For example assume that the value of.

How To Use Rental Property Depreciation To Your Advantage

The basis is also called the cost basis.

. Compare the fair market. Generally this is your cost or other basis in the property including any additions or capital improvements made to the property once you acquired it minus any deductions. Start with the original investment in the.

Next you need to identify closing costs you cant include in your property basis that you instead will expense in your ordinary business operations. First its important to know that basis is the amount of your capital investment in a property and is used for tax purposes. You may also have to capitalize add to basis certain other costs related to buying or producing the property.

With this clients fact set basis for determining loss is 270000 300000-30000. To calculate the capital gain and capital gains tax liability subtract your adjusted basis from the sales price of the property then multiply by the applicable long-term capital gains tax rate. To determine the cost basis of a rental property for depreciation purposes the value of the land or lot must be subtracted from the adjusted basis.

How do I calculate capital gains tax on rental property. Your adjusted basis on the date of the changethat is your original cost or other basis of the property plus the cost of permanent additions or improvements since you acquired it minus. If your sale price.

Rental Property Cost Basis is Tricky. Your original basis in property. Basis for determining gain is 320000 350000-30000.

Since purchasing the property you have invested 30000 into capital improvements. The basis of property you buy is usually its cost. No reportable gain or.

703 Basis of Assets. Certain fees and other expenses you pay when buying a home are added to your basis in the property. Property 4 days ago If you spent 500 on repairs and then another 300 on.

The basis is the purchase price plus related realtor commissions. 150000 30000 - 25000 155000. The starting point for determining her basis is 300000.

A simple formula for calculating adjusted cost basis is. To find the adjusted basis. The cost basis for rental real estate is your acquisition cost including any mortgage debt you obtained minus the value of the land itÕs built on.

To calculate the cost basis add the costs of purchase capital expenses and cost of sale together. Second you calculate the adjusted cost basis of your property. Adjusted Cost Basis Purchase price Depreciation.

Basis is generally the amount of your capital investment in property for tax purposes. Use your basis to figure depreciation amortization. To figure out the adjusted cost basis we use the purchase price minus the annual depreciation rate multiplied by the number of years of ownership and we get 130000.

The basis is used to calculate your gain or loss for tax purposes. Considering the cumulative depreciation on the property the adjusted basis is. Your adjusted basis will be reduced by 100000 20000 depreciation per year multiplied by five years.

If in our example you had capital.

How To Calculate Cost Basis For Rental Property

Rental Property Depreciation Rules Schedule Recapture

Rental Income Expense Worksheet Rental Property Management Real Estate Investing Rental Property Rental Income

Rental Income And Expense Worksheet Propertymanagement Com

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

Understanding Rental Property Depreciation 2022 Bungalow

Rental Property Management Spreadsheet Template Rental Property Management Rental Property Property Management

Rental Property Depreciation Rules Schedule Recapture

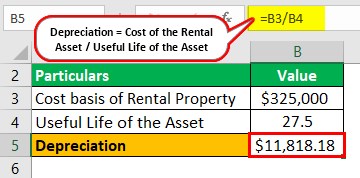

Depreciation For Rental Property How To Calculate

Rental Property Accounting 101 What Landlords Should Know

Depreciation For Rental Property How To Calculate

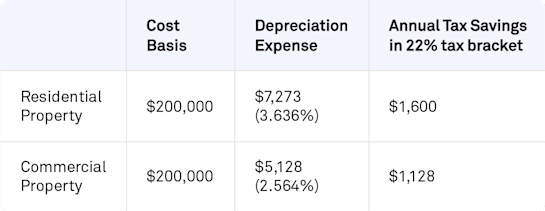

Tax Benefits Of Accelerated Depreciation On Rental Property

How To Calculate Roi On Residential Rental Property

Converting A Residence To Rental Property

Zillow Rent Estimate Calculator Zillow Rental Manager

How Much Rent To Charge For Your Property Zillow Rental Manager