45+ how much should a mortgage be of your income

Apply Get Pre-Approved Today. Ad Calculate Your Payment with 0 Down.

Can Salary Income Be A Security When Taking A Personal Loan Quora

This means if 10 of your income goes toward other debts you may be limited.

. Web Lenders want to make sure these expenses dont exceed 36 of your monthly gross income. Find A Lender That Offers Great Service. Web 25 Post-Tax Model.

Web Most home loans require a down payment of at least 3. Apply Now With Quicken Loans. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax.

Lock Your Mortgage Rate Today. This rule says that you should not spend more than 28 of. Ad Compare Mortgage Options Calculate Payments.

Can an inheritance be rejected. And they see a 28 DTI as an excellent one. Compare Rates of Interest Down Payment Needed in Seconds.

Web Lenders use your debt-to-income ratio DTI as a measure of affordability. Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment. Lock Your Rate Today.

Ad Realize Your Dream of Having Your Own Home. Web A 15-year term. The 3545 Rule The 3545.

View Ratings of the Best Mortgage Lenders. Fannie Mae also lists more than 20 non. Compare More Than Just Rates.

Get Instantly Matched With Your Ideal Mortgage Lender. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Keep your total monthly debts including your mortgage.

Get Instantly Matched With Your Ideal Mortgage Lender. Web How much income do you need to buy a 250 000 house. Ad Compare Mortgage Options Calculate Payments.

Ad Compare the Best Home Loans for February 2023. This estimate is for an individual without other expenses. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your.

Web The Bottom Line. Apply for Your Mortgage Now. Web The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb.

Web However some applicants are required to have at least two years of these earnings to be considered for a mortgage. Learn About Our Fixed-Rate Mortgage Adjustable-Rate Mortgage Jumbo Mortgage Options. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term.

Web If your down payment is 25001 or more you can find your maximum purchase price using this formula. Ad Compare the Best Home Loans for February 2023. Web The higher the multiplier the less you need to earn.

Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage. Down Payment Amount - 25000 10.

Web 46 minutes agothe mortgage is canceled and therefore also the credit. 4 reasons why you should not accept it and how to do it. Lock Your Rate Today.

Were Americas Largest Mortgage Lender. Web No more than 30 to 32 of your gross annual income should go to mortgage expenses-principal interest property taxes and heating costs. For example some experts say you should spend no more than.

Lets say your total. Ideally that means your monthly. Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance.

Lock Your Mortgage Rate Today. Keep your mortgage payment at 28 of your gross monthly income or lower. Web In this example you shouldnt spend more than 1680 on your monthly mortgage to stick with the percentage of income rule for mortgage.

Apply Get Pre-Approved Today. Web Estimate your monthly mortgage payment. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Web A 900000 home with a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403. A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your. Were Americas Largest Mortgage Lender.

Ad Apply Online Today For A Diverse Mortgage Solution To Navigate Your Home-Buying Process. Apply Now With Quicken Loans.

More Inverted Home Loan Rate Offers Interest Co Nz

Long Term Investment Objectives

45 Ways To Live A Great Life Starting In 2023 How To Live A Great Life

What Percentage Of Your Income Should Go To Mortgage Chase

![]()

How Much House Can I Afford Interest Com

Simple Home Affordability Calculator How Much Home Can You Afford

Will I Be Comfortable With A 550k House With A Salary Of 68k R Realestate

What Percentage Of Your Income Should Go To Mortgage Chase

Buy Young Earn More Buying A House Before Age 35 Gives Homeowners More Bang For Their Buck Urban Institute

Bousfield S Blog The Surrey Mortgage Broker

Rnxeb8bafqfxmm

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much House Can I Afford Insider Tips And Home Affordability Calculator

Investing As We Age Research Reports Gerezmieuxvotreargent Ca

Simple Home Affordability Calculator How Much Home Can You Afford

I M 28 With 70 000 Saved For Retirement How Do I Compare With Others In My Age Group And Am I On Track To Be Wealthy When I Retire Quora

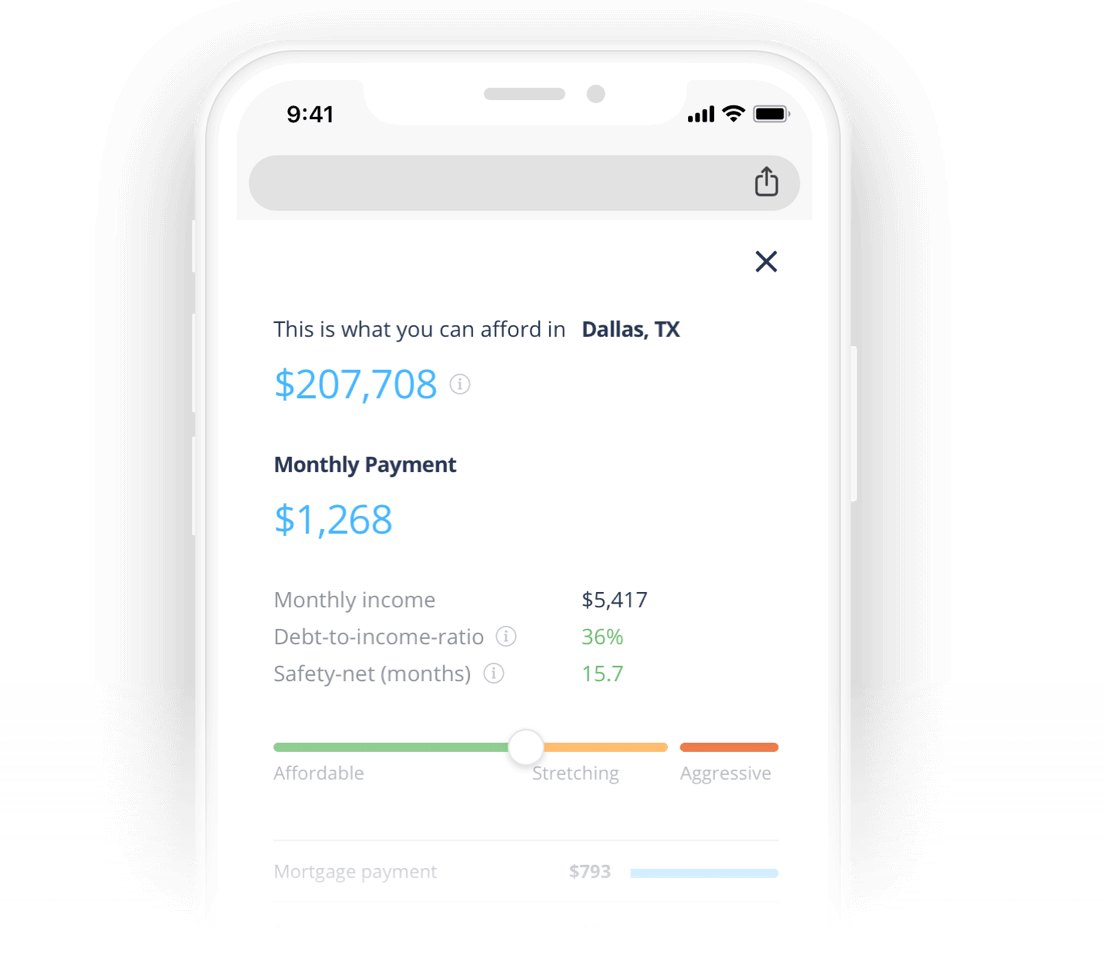

Find Out How Much Home You Can Afford With The 45 Rule